A HOME SEARCH WITH FULL CONSUMER ACCESS!

Just try and use always

Studies show buyers perform their own home search before selecting a real estate professional. The search is at your finger tips through Rochelle's access to the Houston Association of Realtors (HAR) Multiple Listing Service (MLS).

Full Consumer Access to the MLS

Coming soon properties!

Status changes to properties for sale!

> Sold prices and market reports of properties!! <

EXPLORE A NEIGHBORHOOD

Watch this VIDEO to learn about Car Mode and explore a neighborhood.

Set up a neighborhood watch for coming soon or just listed properties.

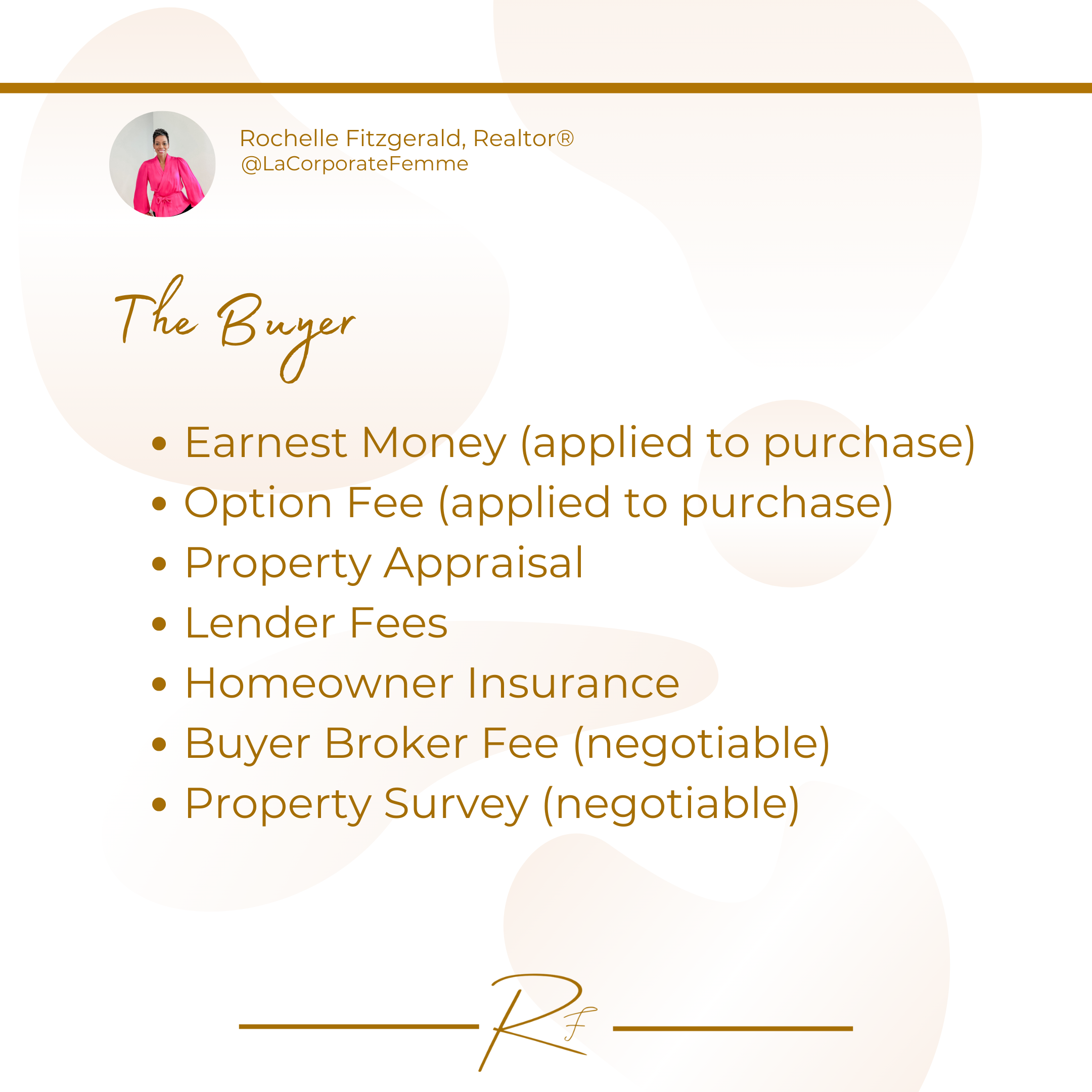

the closing Costs

Who Pays For What?

.

.